Why is Remote Work in Latin America on the Rise?

The standardization of modern employment practices coupled with the shared ordeal of the pandemic, created the perfect conditions to incubate new global economic freedoms.

These conditions have fostered an abundant demand for those seeking remote employment opportunities, and those seeking remote employees, introducing possibilities never before imagined.

As the digital shift transformed the global work landscape, Latin America has emerged as a powerhouse of remote talent, marking its position in the global market as a nexus in the evolving digital workforce.

What factors contribute to Latin America being such an appealing region for remote work opportunities?

According to the International Development Bank’s key report on The Transition to Telework (2023), the trend towards telework is driven by a mix of economic, technological, and cultural factors.

These factors have together created a conducive environment for virtual work to thrive, especially during a time when economic stagnation and hyperinflation plagued many regions during the pandemic.

The increase in telecommuting in South and Central America presents a multifaceted narrative of economic progression and global integration.

The rise in remote job opportunities for locals and expats preferring to live and work in Latam indicates promising signs for economic development.

This growth is further accentuated by the blossoming international collaborations that virtual work facilitates, showcasing a broader canvas of global interaction.

Tech accessibility in Latam is also highlighted as more companies shift to digital platforms for remote work, showcasing the region’s readiness for digital operations.

This change also opens up more access to the transfer of different skills and knowledge sharing, as more global companies are connecting with the varied talents in Latam.

Latam Scope and Relevance

The tech industry in Latin America has been on a steady incline over recent years, with projections for 2023 showing no signs of a deceleration.

As per a report by the Inter-American Development Bank, there was a notable growth of 5.6% in the tech sector in 2022, pushing the industry’s total valuation to a significant $517 billion.

The growth is driven by different factors like investments in the area, a rising number of tech startups, and the adoption of new technologies. In recent times, there has been a remarkable surge in the inception of tech startups, especially in countries like Brazil, Mexico, and Colombia.

A report by the Global Entrepreneurship Monitor underscores Latin America’s entrepreneurial vigor, revealing the region as having the world’s highest entrepreneurship rate with over 15% of the adult populace engaged in entrepreneurial endeavors.

Heading into 2023, the rise of startups is expected to keep growing, boosting the area’s tech scene and a popular scouting ground for teleworkers. These startups are key for bringing new ideas, products, and jobs, which help the local economies.

Investment influx is another factor driving the telework industry’s growth in Latam. The recent years have witnessed a swell in investments from both local and international investors, channelling funds into tech startups, new technology development and infrastructural enhancement, which has increased the demand for labour.

The Latin American Private Equity and Venture Capital Association report sheds light on this investment wave, indicating a record-high VC investment of $4.6 billion in 2023.

According to a report by the Inter-American Development Bank, the fintech sector witnessed a remarkable growth of 77% in 2022, achieving a total valuation of $7.6 billion.

This upward trend is projected to persist in 2024, with an increasing number of startups surfacing in the region. These entities are pioneering solutions to age-old challenges like credit accessibility, playing a crucial role in enhancing financial inclusion and increasing opportunities across the region.

Adding another layer to this growth are the favorable investment policies of Latin American governments. These policies are tailored to allure investments into the region, further fueling the growth of the tech industry and the need to increase organizational headcount.

Economic Advantages of Remote Work in Latin America

Cost Effectiveness

Comparative analysis of wage

A Comparative analysis of wage levels in Latam vs other regions – The region generally has lower minimum wage levels compared to developed countries. For instance, in 2019, Mexico increased its minimum wage to roughly 103 pesos (approximately $8.79 USD) and almost doubled it in the northern border region to roughly 177 pesos, approximately $9.75 USD, (Barbachano International). According to Labs, as of 2021/2022, the minimum wage in some Latin American countries, when converted to dollars, were as follows: Uruguay – $499.32, Ecuador – $425, Chile – $396.89 (value of 2021), Paraguay – $337.1 (July, 2021), and Argentina – $313.45 (2021), (Labs).

This cost advantage makes Latam an attractive location for foreign companies seeking teleworkers, as they can access a pool of talent at a more affordable rate, reducing labor costs while still engaging capable professionals.

Lower operational and infrastructural costs for businesses

Real Estate Cost Savings – The facilitation of remote working can lead to an average of 32% savings in real estate costs across various sectors. In some cases, these savings can reach up to 43%, and even 52% in specific instances, (Capgemini Report).

Company-Specific Savings – Major corporations have reported substantial savings due to telework policies, (The Square Foot).

IBM reported slashing real estate costs by $50 million.

McKesson saved $2 million a year in real estate costs.

Nortel estimated savings of $100,000 per employee and they didn’t have to relocate.

Annual Savings per Employee – Dell reported saving $12 million annually, which translates to roughly $11,000 saved per employee per year, primarily in real estate costs. The savings encompassed rent, building security, insurance, cleaning staff and supplies, on-site catering, and transit allowances, (Deloitte).

Reduced Training and Recruitment Costs – With a growing number of well-educated professionals and tech-savvy individuals, companies might find that the costs of training and recruitment could be lower.

Companies in cities like San Francisco or New York pay tech professionals 4-5x more than in places like Bogota or Mexico City, despite similar skills and job roles. This wage gap could lead to lower hiring and training costs, as companies may find skilled professionals at lower wages, needing less training investment.

The second half of 2021 saw a 286% increase in tech hiring from Latam, indicating a growing recognition of the region’s tech-savvy workforce. This surge in hiring might translate to reduced recruitment costs as a larger pool of ready-to-work professionals requires less investment in training and recruitment processes, (Tecla).

The cost of hiring in Latam is mentioned to range from 200 to 400 USD, which could be lower compared to other regions, indicating a cost-effective recruitment process,(GetonTop).

Favorable Exchange Rates

Exchange Rate Fluctuations: During a period in March, the purchasing power of $1 increased from 19.42 to 25.35 Mexican pesos, marking a 30.5% increase within just three weeks, which means every U.S. dollar sent to Mexico stretches further, (CEMLA).

Comparison of Exchange Rates: In another scenario, 1.00 USD being worth 19.25 MXN (Mexican Peso) showcases how the value of the U.S. dollar compares favorably against the Mexican peso, which can translate to cost savings for U.S. companies when they are hiring remote workers from Mexico, (Remitly).

The favorable exchange rates contribute to Latin America’s attractiveness for nearshoring due to its cost advantages, alongside a highly skilled workforce and proximity to the United States. This has led to many companies choosing to nearshore to countries like Mexico, Costa Rica, and Colombia, which offer a range of benefits, (BizLatinHub).

Other Key Virtual Work Statistics

A June 2020 study highlighted Brazil, Colombia, Chile, and Uruguay as the Latam countries with the highest propensity to broaden telework scopes. (Ipea)

An analysis reinforced that Spanish America and the Caribbean are favorably poised for a transition to work-from-home, with over a quarter of all job roles being potentially executable remotely. Specifically, it’s projected that 31 percent of job roles in Argentina, 27 percent in Chile, 26 percent in Uruguay, and 27 percent in Brazil are adaptable to remote working paradigms.

A growing number of expatriates from the US, UK, CA and Europe opt for residing in Latam nations while embracing the work-from-home model.

Economic Growth In Latin America

Latin America, with its lower living costs compared to North America or Europe, allows businesses to save on expenses while offering competitive salaries to attract top talent. This cost-effectiveness appeals to startups and small businesses aiming to expand affordably. Moreover, the region’s growing talent in software development, sales, and customer service in countries like Brazil and Mexico is catching global companies’ attention.

Talent Pool of Skilled Workers

The talent in South America, significantly contributes to the region’s work-from-home surge. Countries like Brazil, Colombia, Mexico, and Argentina have invested heavily in developing a skilled workforce, particularly in the areas of software development, data science, cybersecurity, and business services like sales and customer success. As a result, companies are increasingly tapping into this diverse and talented pool of professionals to complement their existing teams or spearhead new projects. Here are some things to consider:

Education and Skill Level of Latam Remote Workers

A report by the International Labour Organization highlighted a tenfold increase in offsite work in Latam, indicating a potential rise in the skill level and adaptability of the workforce towards remote working environments.

The evolution of wage differentials and the supply of full-time employees by education level in Latam is a testament to the growing skill levels in the region.

The demand for bilingual employees, particularly those with Spanish-speaking skills, is expected to rise, with 70% of employers predicting high demand for Spanish-speaking skills among job candidates in the next decade, (CPE).

The majority of opportunities in the region are skilled positions, predominantly falling within the areas of technology, with titles such as software engineer, web developer, sales rep, and customer success reps. Most North American firms seeking to hire employees with professional profiles usually hire for those positions.

Upward Mobility and Opportunities

At least 43% of all Latin Americans changed social classes between 2020 and 2023, indicating upward mobility trends in the region.

Intergenerational mobility is also observed to be rising on average in Latam, driven by the high upward mobility of children from low-educated families, which could be an indicator of economic opportunities and possibly tied to online work scenarios, (Science Direct).

Tech Savvy Population

Despite a significant portion of the population lacking internet access, there has been a notable digital transformation in Latam offering a unique opportunity to boost productivity and provide better services. The COVID-19 pandemic has sped up digital changes, but there’s still some distance to cover to catch up with more advanced economies., (World Economic Forum & CEPAL). Despite the gaps exposed by the digital revolution, there was a great knowledge transfer and the introduction of productivity and process software designed to enhance operational efficiency. Common tools employed by numerous North American and European tech companies include but are not limited to Aircall; Freshsales; Pandadoc and Remote just to name a few.

Chile and Costa Rica reached a digital readiness index of 14.86 out of 25 in 2019, the highest score among countries in Latam and the Caribbean, indicating a level of preparedness for digital transformations, (Statista).

Latam has the fourth largest online market, with Brazil and Mexico being among the top 20 world economies by GDP, (Forbes).

Internet Connectivity

Over the past decade, Latam has seen significant enhancements in internet connectivity, a crucial element of online work. With an average internet penetration rate of 68.8 percent, the region is rapidly closing the gap with other global regions, such as the OECD countries.

This increased accessibility to broadband connections, particularly in the mobile mode, has brought about fundamental changes and opportunities in the region.

Despite these advancements, there remain challenges to overcome, such as costly fees and inadequate service quality in rural areas. However, ongoing efforts to improve internet connectivity, including public-private partnerships and digital inclusion programs, are helping to address these issues and ensure a bright future for e-jobs in Latam.

Cultural Factors Supporting Remote Work

The unique cultural attributes of Latam significantly influence the success of telework, adapting well to this contemporary working style, which includes a growing proficiency in English and an increasing cultural influence from the US.

At the heart of Latam culture is a strong emphasis on collaboration friendly people and community, fostering a sense of teamwork and support that translates seamlessly to virtual work environments.

Work-Life Balance

It is known that online work has a positive impact on work-life balance. A study conducted across several countries, including Latam, showed that 82% of remote workers reported lower stress levels, (Mexico Tech Salaries Report).

Time Zone Compatibility

Latam and North America’s similar time zones make real-time collaboration and communication easier for remote work. This time zone alignment, crucial for companies operating across regions, enhances productivity by reducing issues tied to different work schedules.

Latin American countries adapt well by adjusting work hours to sync with clients or team members elsewhere. With flexible work setups and digital tools, remote workers in Latam effectively handle time zone differences, aiding the success of geographically spread teams.

Emphasis on Collaboration and Community

The strong emphasis on collaboration and community in Latam’s culture positively impacts e-work success, enabling remote workers to communicate, problem-solve, and share knowledge globally.

In cities like Mexico City and Buenos Aires, coworking spaces are popular among Latam’s remote workers and digital nomads. These spaces not only provide a functional workspace but also foster community, further promoting the region’s reputation as a telework powerhouse.

Navigating Language Barriers

Navigating language barriers in Latam, particularly in the professional or online work setting, can present challenges. However, various language policies and initiatives have been implemented across the region to promote bi- and multilingualism, which could potentially ease these barriers.

There are language policies that aim to encourage plurilingual orientations as opposed to monolingual orientations, which are designed to intervene in the educational systems to provide options for learning multiple languages, thereby aiding in overcoming language barriers, (30 Lngugage Policy).

The Association of Language Services of Latam and the Caribbean (ASLALC) was established as a platform to address service language needs in the region. English was chosen as the official language for the association, indicating a recognition of the importance of English proficiency for international communication and e-work opportunities, (Multilingual).

Digital Nomads Complementing the Latin American Remote Labour Force

Companies seeking remote talent have an added advantage in not only sourcing individuals local to Latam, but also tapping into the community of digital nomad professionals residing within Latin America.

These digital nomad individuals attracted to the region’s cost-effective living, are often willing to earn at local rates, as is the case in most Latin American countries, thereby supporting their nomad lifestyle.

This scenario creates a mutually beneficial arrangement, as businesses can access a diverse pool of skills from digital nomad professionals while continuing their exploration of the employment market in Latin America.

This blend of local and digital nomad talent significantly broadens the spectrum of expertise and cultural insights available to companies, making the digital nomad community an invaluable asset in today’s professional world where people are able to work remotely.

There are an estimated 35 million digital nomads worldwide as of 2023, contributing a global economic value of $787 billion annually. Mexico is currently the most popular destination of the global digital nomad community, where people from the United States, United Kingdom and even Europe work remotely.

A joint study by WeWork and Page Resourcing indicated that 82% of workers in Mexico enjoy the benefits of flexible jobs, which has significantly boosted their performance. Mexico’s digital nomad scene is burgeoning due to factors like a generous six-month tourist visa, relatively low cost of living, and favorable weather

Argentina is projected to host over 22,000 digital nomads by 2023, with Buenos Aires being a highly rated city for digital nomads in 2021, considering factors like digital connectivity, legal stay, cost of living, safety, weather, culture, and leisure

The life of the digital nomad has also been legislated into Colombian immigration law as of October 2022, attracting digital nomads with its low cost of living. For instance, a six-month rent for a one-bedroom flat in Bogota is around €2,087.

Infrastructure and Government Policies

The rise of e-jobs in Latam is being facilitated by:

Infrastructure enhancements

Supportive government policies

Enhancements in internet connectivity for people who work remotely

The introduction of digital nomad lifestyle and visas

the emergence of the co-working space

These factors are proving beneficial for both companies and remote employees, enabling more seamless and efficient online work experiences.

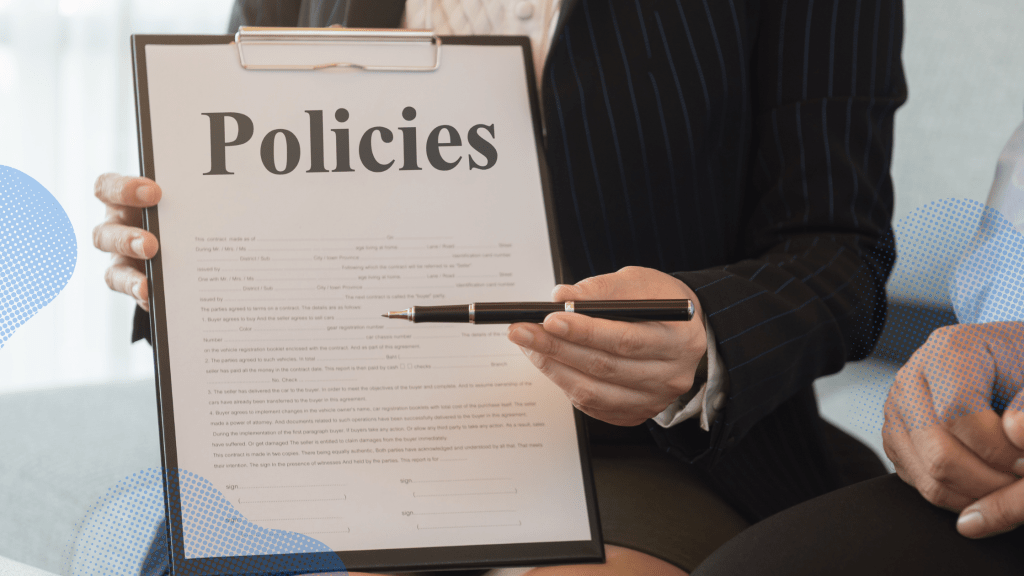

Here’s an outline of the government policies and regulations concerning remote hiring by foreign companies:

Regulations Supporting Telework In Latam

In Mexico, a draft of Norm 037 was published on 15 July 2022, focusing on health and safety standards for telework. It mandates employers to ensure internet connectivity and adequate health and safety conditions at teleworking locations. Additionally, a teleworking policy must be established in writing, informing teleworkers of relevant risk factors and providing ergonomic chairs and equipmentNavigating Regulations, (Chambers).

In Brazil, Law 14,442 has been introduced to regulate teleworking. Initially temporary, these provisions have now become part of the Brazilian legal system. The definition of telework has been expanded to include any work arrangement with an e-jobs component, requiring employers to review their current practices for compliance with the new regulations.

The United Nations Conference on Trade and Development (UNCTAD) reported that FDI in Latam and the Caribbean increased by 56% to $134 billion in 2021, recovering from a pandemic-induced slump. This indicates a favorable environment for foreign investments, which could be an incentive for businesses from the UK, US, Canada, and EU.

In Costa Rica, a Digital Nomads Law has been enacted to attract remote workers and international service providers. The law includes tax benefits such as corporate income tax and import tax exemptions. This might attract foreign companies looking to set up e-work operations in Latam, (Ernst & Young).

Hiring remote workers from different countries can complicate the task of navigating local regulations. Accurately classifying workers and ensuring compliance with local employment laws is essential to avoid fines, legal fees, and back-dated liabilities.

One way to overcome the complexities of local regulations is to work with professional employment organizations (PEOs), which specialize in helping employers navigate the legal intricacies of hiring remote workers in different countries. By understanding and adhering to local regulations, companies can mitigate potential risks and ensure a successful remote work arrangement for all parties involved.

Several Latin American countries have introduced or are in the process of introducing digital nomad visas to attract remote workers. For instance, Argentina recently introduced a new digital nomad visa, reflecting a trend among nations in Latin America and the Caribbean to attract remote workers due to the economic advantages they bring, (Nearshore America).

To accommodate the increasing number of remote workers, the governments of Latam have implemented digital nomad visas. These visas enable remote employees to work legally from a foreign country, providing them with the flexibility and autonomy to pursue their careers from any location.

Success Stories: Companies Leveraging Latin American Remote Talent

Numerous companies have already reaped the benefits of tapping into Latin America’s remote talent pool, proving it’s more than just a theoretical advantage. Some of the benefits include:

Reducing hiring costs

Expanding operations

Accessing a diverse talent pool

Increasing productivity and efficiency

Improving work-life equilibrium for employees

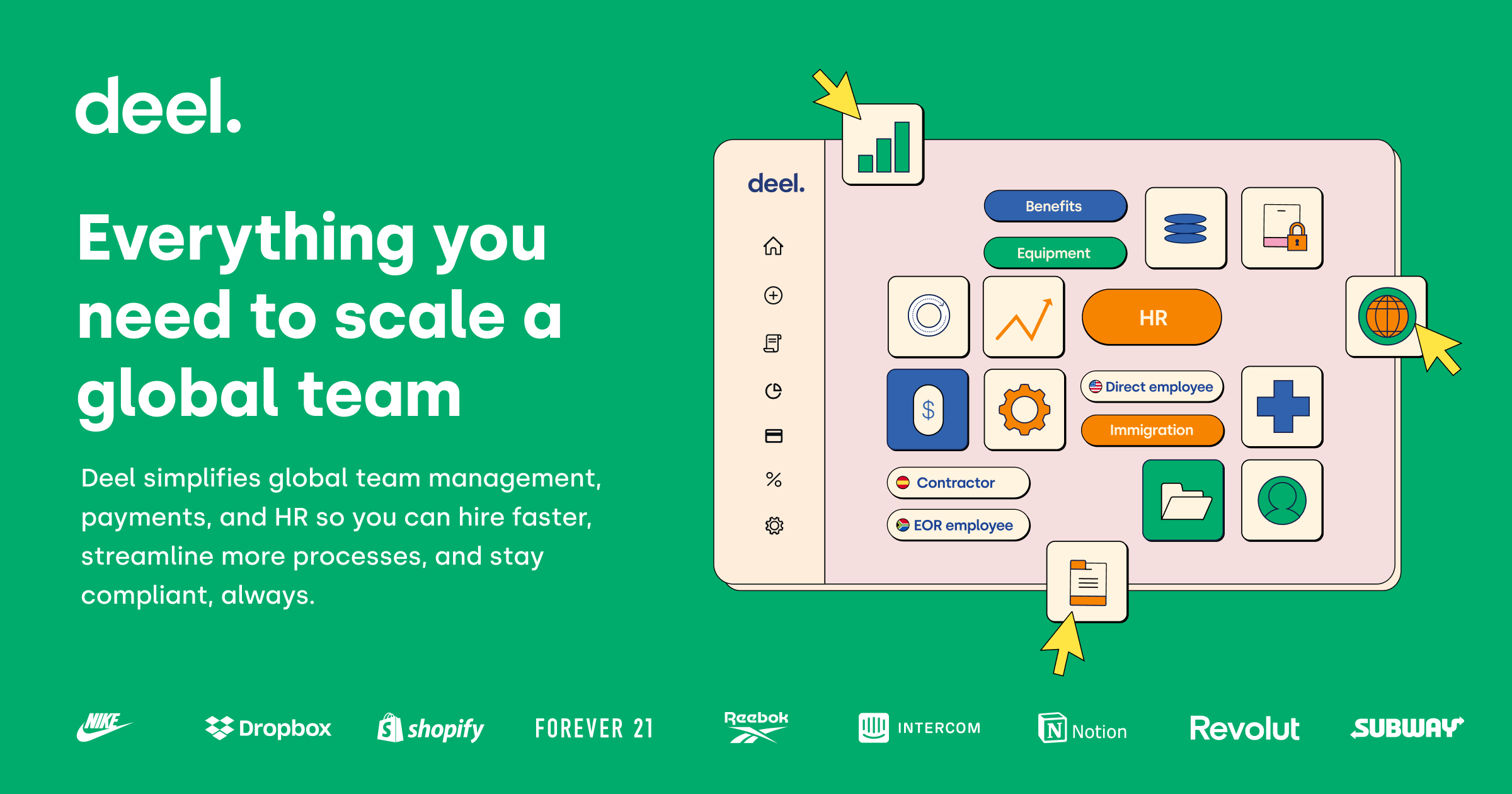

One such company is Deel, a company that has exemplified the potential of Latin America as an e-work hub and serves as inspiration for other organizations considering a similar approach.

Case Study – Deel

Deel is a privately held payroll and compliance provider based in San Francisco, California, specializing in international hiring and payments.

Deel has extended its operations into Latin America, particularly in Brazil and Mexico, to tap into the region’s robust talent pool.

This move is aligned with the increased global hiring trend, where Latin America has shown a remarkable 161% increase in recruitment activities, making it a lucrative market for Deel’s services, (Bloomberg).

In their move to hire remote workers, Deel has successfully leveraged Latin American remote talent to achieve the following:

Strategy

Market Entry – Entered the Latin American market starting with Mexico followed by Brazil, anticipating that Brazil would account for 10% of its revenue, (LatiamList, Labs). Additionally, Deel’s expansion into Latin America aimed at tapping into the region’s cost-effective and skilled talent pool

Product Enhancement – Expanded into 19 countries with more than 700 payment methods enabled since 2020 to cater to diverse global financial systems, (Business Wire).

Results

Market Growth – Seen a notable increase in recruitment activities from and to Latin America by 161% in recent months, highlighting the successful market penetration, (Bloomberg).

Cost efficiency – Latin America is known for its cost-effective labor compared to North American and European markets. By facilitating access to this talent pool, Deel enables its clients to realize significant cost savings in labor expenses.

Operational Costs – Deel’s platform inherently supports e-work, reducing the necessity for physical office spaces and associated overhead costs. This operational model further amplifies cost savings for both Deel and its clientele.

Global Compliance – Global Compliance: Deel’s platform helps companies navigate the complexities of international hiring and payment compliance. Engaging with Latin American markets provides local regulatory expertise, further enhancing Deel’s global compliance capabilities.

Business Impact – Latin America tops the list of regions with the most companies hiring from abroad, aligning with Deel’s mission of fostering global hiring, (Bloomberg).

Lessons Learned

The significant growth in recruitment activities validates the market potential of the Latin American market for global hiring outcomes.

The Future of Online Work in Latin America

Projected Growth

The projected growth of online work in Latin America is supported by a multitude of data and insights from various sources.

For instance, in the second half of 2021 alone, tech hiring from Latin America increased by 286%, showcasing the region’s burgeoning tech talent and its alignment with e-work opportunities.

Moreover, a survey disclosed that over 50% of Latin Americans continued working from home despite eased travel restrictions, indicating a significant adoption of virtual work culture in the region.

A study by the International Labor Organization highlighted a tenfold increase in telework in Latin America, underscoring the rapid shift towards remote working norms.

Additionally, data from CodersLink revealed that post-pandemic, the percentage of people working 100% remotely in Latin America surged from 14% to 36%.

This trend is particularly pronounced in Mexico, where 68.7% of working tech professionals prefer at least some form of work from anywhere, substantiating the growing preference for remote or hybrid work models in the region.

The expansion of e-work in Latin America isn’t confined to just one sector; top remote-working industries include consulting, technology, education, marketing, and entertainment, mirroring global trends.

As for authoritative insights, various sources corroborate the rise of remote and hybrid work models in Latin America. For instance, a piece on LinkedIn titled “Latin America’s Remote Workforce: Thriving in the New Normal” discusses how these work models are helping win the talent war in region.

Similarly, a report from Remote.com emphasizes the shift towards distributed teams as companies prepare for an e-work-centric future, including in Latin America.

The evolution of online work is also echoed in legal circles, with Chambers.com discussing the fluid state of remote working regulations in Latin America, indicating an ongoing transition towards more flexible work arrangements.

Furthermore, the rise of the gig economy coupled with virtual work is highlighted as a significant trend impacting the tech industry in Latin America, offering professionals increased flexibility and autonomy.

These varied sources collectively underline the ongoing transformation in Latin America’s work culture, driven by the demand for skilled professionals and the advantages offered by telework work models.

This shift is not only reshaping the job market but also contributing to the region’s economic development and innovation, aligning well with the global trajectory towards more flexible and remote work arrangements.

Global Impact

The success of remote jobs in Latin America reverberates beyond its borders, impacting the global digital movement.

As more companies recognize the benefits they achieve when they hire remote workers from the region, Latin America’s remote work model could serve as an inspiration for other countries and regions looking to adopt similar practices.

Additionally, the growth of remote work in Latin America is anticipated to have a worldwide effect on the job market and the economy, creating new opportunities for remote workers and fostering a more diverse and global workforce.

As remote work continues to expand its foothold in Latin America and around the world, its impact will be felt across industries, borders, and cultures.

Gain Access to Remote Reps

Gain access to a vast selection of over 500 profiles of remote job candidates, and effortlessly tap into a global list of remote sales job candidates, all at your fingertips!

Key Takeaways

Latin America is an attractive hub for remote work opportunities due to its cost-effectiveness, tech talent pool and digital skills proficiency.

Remote jobs in Latin America is projected to grow with a global impact on the job market, economy, and workforce.

The cost of hiring in Latin America is considerably lower, ranging from 200 to 400 USD, as compared to hiring in cities in the US, UK or EU.

Favorable exchange rates further amplify cost savings for U.S. companies when hiring remote workers from Latin America.

Due to a growing pool of well-educated, tech-savvy professionals and many workers in Latin America, companies might incur lower training and recruitment costs.

Infrastructure enhancements, supportive government policies, and the introduction of digital nomad visas in various Latin American countries facilitate the rise of remote work in the region.

Sign Up to Our Newsletter

For more information B2B sales content, tools and tips, from the tech industry sign up to receive our Sales Agency newsletter.